AI TECHNOLOGY USED BY EQUIDIT

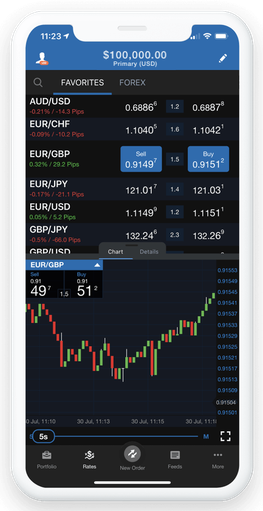

At Equidit, we use a combination of artificial intelligence and machine learning algorithms to make trades on financial markets. Our technology stack includes several key components, including:

Data collection: We use a variety of sources to gather data, including historical market data, news articles, and social media posts. This data is used to inform our trading decisions and identify patterns and trends in the market.

Natural Language Processing (NLP): We use NLP techniques to extract relevant information from news articles and social media posts. This allows us to identify sentiment and trends in real-time, which can inform our trading decisions.

Machine Learning Algorithms: We use a variety of machine learning algorithms, including supervised and unsupervised learning, to analyze the data we collect. These algorithms help us to identify patterns and trends in the market that humans might miss.

Deep Learning: We use deep learning algorithms, such as neural networks, to make predictions and identify patterns in the market data. These algorithms are particularly effective at handling large amounts of data and identifying complex patterns.

Reinforcement learning: We use reinforcement learning algorithms to train our models to make better decisions. This is done by providing the model with rewards and penalties based on its performance and learning from the feedback.

Execution: Once the trade decisions are made, we use a low-latency execution platform to execute the trades quickly and accurately.

All of these technologies are integrated into a single system that is constantly monitoring the market and making trades in real-time. We use a combination of supervised and unsupervised learning algorithms to make predictions and identify patterns in the market data. We also employ reinforcement learning to optimize the models and make better decisions. Our proprietary technology allows us to make trades faster and more accurately than traditional trading systems